This is an English translation of the Articles of Association of Lífeyrissjóður verzlunarmanna and is published for informational purposes. In the event of any discrepancy between this English translation and the original version in Icelandic version, the Icelandic version prevails.

Articles of Association

- All articles of association

- Articles 1.-11. regarding operation, supervision and governance of the fund

- 12. Retirement pensions

- 13. Disability pensions

- 14. Spouse’s pension

- 15. Child's pension

- Articles 16.-25. regarding payments, private pension divisions, amendments and entry into force

- Annex A and B - Entitlement tables

Disclaimer

PDF - Articles of association

1. Fund name and domicile

1.1. The fund is called Lífeyrissjóður verzlunarmanna. The fund’s domicile and legal venue is in Reykjavík. The fund’s foreign trading name is Pension Fund of Commerce.

2. Role of the fund

2.1. The fund's role is to ensure its members, their surviving spouses and children pension benefits in accordance with the rules laid down in these Articles.

2.2. The fund operates on the basis of the collective agreement between the Icelandic Confederation of Labour (ASÍ) and the Confederation of Icelandic Enterprise (SA) of 12 December 1995, and the agreement between ASÍ and SA of 24 April 2018, cf. the agreement between the Commercial Workers of

Reykjavík (VR), SA and the Icelandic Federation of Trade (FA) of 23 April 2018.

2.3. The fund operates under the Act on Mandatory Pension Insurance and on the Activities of Pension Funds, No. 129/1997.

2.4. The fund places special emphasis on retirement pension benefits and reserves the right to prioritise protection of those rights when reviewing the entitlement provisions of these Articles.

3. Divisions

3.1. The fund operates three divisions:

A Division, which is a mutual division. Statutory or contractual contributions are paid to A Division, cf. Articles 10.1 and 10.2;

B Division, which is a private pension division. Supplementary pension contributions are paid to B Division, cf. Art. 10.3; and

C Division, which collects private pension contributions, as provided for in Act No. 129/1997, referred to in these Articles as a specified private pension,.cf. Art. 10.3.

3.2. The following Articles apply only to A Division: Articles 8, 11 to 18, and 25.2; Art. 19 of the Articles of Association applies only to B Division; and Art. 20 applies only to C Division

4. Membership

4.1. Fund members shall be all employees who are members of VR covered by the union’s collective agreements with employers, unless otherwise specifically provided for in a wage agreement. Members of other commercial workers’ associations may be members of the fund.

4.2. Furthermore, employees whose terms of employment are based on VR’s collective agreement are entitled and obliged to become members of the fund, if the agreement determines the minimum terms of employment for their employment sector or the terms of employment in the employee's contract are

based on that agreement and the employee is not a mandatory member of another pension fund.

4.3. Membership shall commence from the first day of the following month after the employee reaches the age of 16 years.

4.4. Self-employed persons and individuals whose terms of employment are not based on a collective agreement may be members of the fund.

4.5. The fund’s Board of Directors may, after obtaining the approval of its member organisations, grant entire groups of employees membership of the fund. An application for such membership must be made in writing.

4.6. The fund’s members are those persons who pay or have paid a contribution to the fund, as well as persons benefiting from a retirement or disability pension from the fund under Articles 12 and 13.

4.7. Fund membership is terminated if a fund member receives payment of their entitlement in a lump sum or if the entitlement is transferred according to pension fund rules to another pension fund

4.8. Fund members and other employees, and persons engaged in business operations or self-employed, may pay contributions to B Division of the fund as private pension savings, as provided for in Act No. 129/1997, and to C Division as a specified private pension.

5. Board of Directors and Managing Director

5.1. The fund’s Board of Directors shall be composed of eight persons. Four directors shall be nominated by VR, three by SA and one shall be nominated by FA. Each of the fund’s above-mentioned member organisations shall also nominate one alternate director.

5.2. The Board's term of office shall be until the fund’s next annual general meeting. Nominations to the fund’s Board of Directors shall be made as follows: VR nominates four directors, two of which are nominated every other year for a four-year term. SA nominates three directors, one or two each year for a two-year term, and FA nominates one director every other year for a two-year term. VR, on the one hand, and SA and FA on the other hand, shall each have nomination committees to examine the qualifications and eligibility of those individuals prepared to serve as directors of the pension fund, taking into consideration i.a. Art. 5.8 on general eligibility of directors. VR for its part and the employers’ associations for their part shall set working rules for their nomination committees.

Temporary provision: Initial nominations shall be carried out by having VR nominate two directors

for four years and two for two years, SA shall nominate one director for two years and two for one year, and FA shall nominate one director for two years.

5.3. A director may resign before the end of their term, in which case the director shall send notification thereof to the fund’s Board of Directors and the organisation who nominated them. The nominating party may revoke a director’s nomination before the end of their term if the director is in breach of their duties as prescribed by law, these Articles of Association or other currently applicable rules. Grounds must be

provided for revocation of nomination and it must be confirmed by representatives of the nominating party in question who are members of the fund's Council of Representatives and formally notified to the fund's Board. If a director resigns before the end of their term of office, the director’s alternate shall replace them until the organisation which nominated the director has nominated a new director to the Board as provided for in the applicable rules in these Articles. The new director shall remain until the end

of the term of office of the outgoing director.

Council of Representatives– Appointment and role

5.4. The pension fund's member organisations shall operate a Council of Representatives for the pension fund, comprised of 50 delegates. VR appoints 25 representatives, SA 23 representatives and FA 2 representatives. Appointments to the Council of Representatives shall be made according to agreements of the fund's membership organisations and the relevant rules adopted by these organisations.

5.5. The pension fund’s member organisations shall notify the fund of the names of their current respective representatives. Any changes to appointed representatives shall also be notified. A list of the names of representatives and, as applicable, their alternates, who will attend the fund's annual general

meeting shall be delivered to the Board of Directors of the fund no later than two weeks before each annual general meeting.

5.6. The Board of Directors of the pension fund shall convene the Council of Representatives twice yearly, once in the autumn and once prior to the annual general meeting. These meetings shall discuss issues of concern to the fund, including key figures on the fund's performance, the progress of its investment strategy and, as the case may be, preparations for amendments to its Articles of Association. The Board may convene the additional meetings of the Council of Representatives if occasion so warrants.

5.7. The role of the pension fund’s Council of Representatives shall be as follows:

5.7.1. Representatives of VR in the Council of Representatives shall approve directors nominated by VR, representatives of SA in the Council of Representatives shall approve directors who have been appointed by SA and representatives of FA in the Council of Representatives shall approve the director whom FA has appointed. Alternate directors shall be approved in the same manner. The fund's member organi-sations shall arrange meetings of their representatives to discuss approval of their nominated directors

according to the rules which the respective nominating body has adopted concerning this. If an individual nominated by a nominating body is not approved by its representatives in the fund’s Council of Representatives, the nominating body shall nominate another person to serve as Director in

accordance with the same rules.

5.7.2. Representatives in the Council of Representatives shall vote at the fund’s annual general meeting on behalf of their member organisations on the decisions listed in Art. 6. Each representative is authorised to cast votes of two other representatives in addition to their own vote. A simple majority shall

determine the outcome of voting by the Council of Representatives unless otherwise required in these Articles. If so requested by four or more representatives, separate votes shall be held, with VR’s representatives casting their votes, on the one hand, and representatives of SA and FA together, on the

other hand; in such case the approval of at least 13 representatives from each part of the Council of Representatives is required for lawful approval of a matter.

5.7.3. The Council of Representatives shall generally monitor the fund's activities, the work of the Board and provide restraint. The Council examines, for instance, the annual financial statements, investment policy and the fund's annual report.

General eligibility of Directors

5.8. The general eligibility of directors to serve on the Board of Directors of the pension fund is governed by applicable law at any given time, currently the first to fourth paragraphs of Article 31 of Act No. 129/1997, as subsequently amended.

5.8.1. In appointing their directors, the employers' organisations referred to in Art. 5.1 shall ensure an equal gender distribution. The same applies to directors appointed by VR.

5.8.2. The pension fund’s member organisations shall consult with each other to ensure that the fund’s Board of Directors as a whole possesses sufficient expertise and experience to fulfil its role.5.8.3. A director may serve a maximum of eight consecutive years, as a regular member of the Board of Directors.

Role of the Board of Directors and division of responsibilities

5.9. The Board shall divide its tasks among the directors, however, ensuring that representatives of employers and of VR serve alternately as chairperson for two years at a time. The Board of Directors shall adopt working rules and keep a book of minutes, recording the discussion and actions at Board meetings, signed by those persons present at the meeting. A Board meeting has a quorum if at least five directors or alternates attend. In its work the Board of Directors shall have regard for Guidelines on Corporate Governance, as applicable to the pension fund’s activities (currently the 6th edition of Guidelines issued by the Iceland Chamber of Commerce, SA and NASDAQ Iceland). Directors shall

perform their duties with integrity, be able to devote sufficient time as required of directors for board work and make independent decisions in each individual case.

5.10. The Board of Directors is the supreme authority in the pension fund’s affairs between annual general meetings. The Board of Directors of the fund shall promote the fund's successful operation and long-term performance. It is responsible for its activities and for ensuring that its organisation and

activities are always sound and proper. It makes strategic decisions regarding the fund's situation and operations and ensures that its day-to-day operations, including accounting and management of the fund's financial assets, are adequately monitored. The fund’s Board of Directors establishes internal quality control and documented supervisory processes for the pension fund.

5.11. The fund’s Board shall hire the head of its Audit Division or reach agreement with an independent supervisory party to handle internal quality control. Furthermore, the Board of Directors submits a proposal to the annual general meeting on an external certified auditor or auditing firm to carry out auditing of the fund.

Managing Director

5.12. The fund’s Board of Directors shall hire a Managing Director, determine their salary and other terms of employment, grant the Managing Director power of procuration for the fund and set rules on their work. The Managing Director is not eligible to serve as a director of the fund.

5.12.1. The Managing Director is responsible for the fund’s daily operations, that they accord with statutory provisions and the fund's Articles of Association, together with policies and instructions issued by the fund's Board of Directors. The Managing Directors shall hire other personnel for the fund. The Managing Director may not participate in business operations unless the Board of Directors has granted permission for such.

5.12.2. Daily operations do not include measures which are unusual or of major significance. The Managing Director may only take such measures in accordance with specific authorisation from the Board of Directors, unless it would not be possible to await decisions of the Board without considerable

inconvenience for the fund’s operations. In such instances the Board shall be notified of the measure. The Managing Director is to ensure that the fund’s accounts are kept as provided for by law and good accounting practice and that handling of its assets is secure.

5.12.3. The Managing Director is required to provide the fund's Board of Directors and auditors with all information on the fund's situation and activities they request Special eligibility of directors

5.13. The rules of Chapter II of the Administrative Procedures Act, No. 37/1993, on special eligibility apply, as appropriate, to the handling of cases and decisionmaking by the fund's Board of Directors in individual cases.The eligibility of persons endorsed by the fund to work as directors

5.14. The general and special eligibility of directors endorsed by the fund to work as directors in individual companies is governed by the rules of company law and the special rules of the companies concerned. In addition, considerations expressed in LV’s policies and criteria are taken into account.

Other provisions regarding mandate and duties

5.15. Directors, the Managing Director and others authorised to represent the fund may not take any measures which are clearly liable to unduly promote the interests of certain fund members, enterprises or others beyond those of other parties or to the detriment of the fund.

5.16. The Board of Directors, the Managing Director and other employees, as well as the auditors of the fund, are bound by an obligation of confidentiality concerning anything they may become aware of in their work for the fund and which should by its nature or by law remain secret.

Remuneration Committee

5.17. The annual general meeting shall elect four individuals and two alternates to a Remuneration Committee for a two-year term. One of these committee members shall be the chairman of the fund’s Board of Directors.

5.17.1. The proportion of employers’ and employees’ representatives on the committee shall be equal.

5.17.2. The committee shall have a quorum if three members attend a meeting. A simple majority of votes shall determine the committee's decision.

5.17.3. The committee shall adopt working rules and divide tasks between members.

5.17.4. The committee shall prepare and submit proposals for the remuneration of directors, both regular and alternate, to each annual general meeting. The committee’s proposals shall aim to have the remuneration of directors reflect the requirements made of them, for instance, regarding responsibility,

specialised expertise, experience and the time required for Board work. The committee shall present its proposals to the Board no later than two weeks prior to the fund’s annual general meeting.

6. Annual General Meeting

6.1. The fund’s annual general meeting shall be held before the end of June each year.

6.2. All members of the fund, members of the fund's Council of Representatives and rightholders in B and C Divisions are entitled to attend meetings with the right to speak and submit motions.

6.3. The fund's Board of Directors shall convene its annual general meeting with at least two weeks' and no more than four weeks’ notice. The meeting shall be convened publicly with an advertisement and a written announcement of the meeting sent to the fund's member organisations with the same notice as applies to the convening of the annual general meeting.

6.4. The fund’s Board of Directors may convene an Extraordinary General Meeting. Regarding the convening of the meeting, reference is made to Art. 6.3. An extraordinary general meeting may discuss the same items as are discussed at the annual general meeting; provisions on the annual general meeting shall apply mutatis mutandis to the extraordinary general meeting.

6.5. The Council of Representatives provided for in Art. 5 has the right to vote at the annual general meeting. The majority required shall be as provided for in Art. 5.7.2.

6.6. The annual general meeting has supreme authority in the affairs of the pension fund unless otherwise provided for by law or in these Articles of Association.

6.6.1. At the annual general meeting the following shall be presented:

6.6.1.1. Report of the Board of Directors

6.6.1.2. Annual financial statements for the previous year of operation 10

6.6.1.3. Actuarial audit

6.6.1.4. The fund’s investment strategy;

6.6.1.5. The fund's shareholders' policy

6.6.1.6. Composition of the Board of Directors

6.6.1.7. Composition of the Council of Representatives

6.6.2. At the annual general meeting the following shall be presented and voted

on:

6.6.2.1. The fund's Remuneration Policy

6.6.2.2. Selection of members for the Remuneration Committee

6.6.2.3. Motion on directors’ remuneration

6.6.2.4. Motion of the Board of Directors for an auditor or audit firm

6.6.2.5. Motion of the Board of Directors to amend the fund’s Articles of Association

6.6.3. Other business.

6.7. Motions for resolutions by the annual general meeting must be submitted to the fund's Board of Directors in writing no later than one week prior to the annual general meeting.

7. Accounting, auditing and supervision

7.1. The fund’s financial year shall be the calendar year. Audited financial statements must be available no later than 1 March of the following year.

7.2. The fund’s annual financial statements shall be audited by a certified auditor or audit firm. The fund's annual financial statements shall be prepared in compliance with laws and good accounting practice. Statutory provisions shall apply concerning eligibility of auditors.

7.3. Provisions of Chapter IX of Act No. 129/1997 apply to supervision of the fund’s activities.

7.4. Contributions paid to B and C Divisions shall be the private property of the rightholder paying them and specified in their individual account.

7.5. The operations of B and C Divisions shall be financially separate from the operations of A Division. Joint costs shall be allocated in a reasonable and unambiguous manner among the operational areas of the divisions.

7.6. The interest which is to be credited to B and C Division private pension accounts at the end of the year shall be calculated for each private pension account on the balance at the beginning of the year and of the payments and disbursements during the year in accordance with the Division’s return on

assets.

8. Actuarial audit

8.1. Each year the fund's Board of Directors shall have an actuarial audit carried out of the A Division’s financial situation and its future position assessed. This audit shall be part of the fund’s accounts each year. The actuarial audit shall be carried out by an actuary or other party accredited for such work. The audit shall take into account the provisions of Chapter IV of Regulation No. 391/1998. The audit shall be sent to the Financial Supervisory Authority (FSA) of the Central Bank of Iceland.

8.2. The pension fund's net assets for payment of pensions, together with the present discounted value of future contributions, shall be equal to the present discounted value of the expected pensions arising from contributions already paid and future contributions. The plan for future contributions and expected

pensions shall be based on the fund members at the time used as a basis for the actuarial audit.

8.3. Should the actuarial audit reveal greater deviations between asset items and pension liabilities, as referred to in Art. 8.2, than are provided for in the second paragraph of Article 39 of Act No. 129/1997, the fund's Board of Directors must make proposals to the fund's member organisations on necessary

amendments to the fund's Articles of Association. The fund's Board of Directors may increase or decrease the pension entitlement if the difference between asset items and pension liabilities is within a 5% limit, after consultation with the fund's actuary.

9. Allocation of capital

9.1. The fund's Board of Directors formulates its investment strategy and sees to the allocation of its capital. It is required to invest its capital with a view to obtaining the best terms available at any given time, taking into account the risk and the fund's long-term obligations. The fund’s Board may formulate a separate investment strategy for each individual division of the fund, cf. Articles 3.1, 19.4 and 20.5.

The fund’s investments and investment strategy shall comply with statutory authorisations and satisfy all the requirements concerning form and substance made by mandatory statutory provisions of the Act on Mandatory Pension Insurance and on the Activities of Pension Funds, currently Chapter VII of Act

No. 129/1997, and all current binding administrative provisions.

9.2. The fund’s Board of Directors shall formulate an investment strategy which sets criteria for the extent of investments in individual types of assets, cf. Art. 9.1. It shall also set out objectives, among other things, for the distribution of assets, duration of claims, currency composition, liquidity and other criteria

that the Board of Directors considers necessary to provide as clear a picture of the pension fund’s financial position as possible.

9.3. At the annual general meeting, the Board shall submit an investment strategy and account for changes from the previous year.

10. Pension contributions

Contribution base and minimum contribution to the mutual division, A Division

10.1. A fund member’s minimum contribution to A Division shall be 12% of total salary and remuneration for all types of work, duties or service, whatever they are called, if they are taxable under the first paragraph of Point 1 of Part A of Art. 7 of Act No. 90/2003, on Income Tax. The contribution base does not, however, include benefits paid in kind or payments which are reimbursement of expenses paid, cf. the first paragraph of Art. 3 of Act No. 129/1997. In the case of employees, the contribution is divided so that the employee pays 4% while the employer pays 8%.

10.2. The contribution base of a fund member who is a sole proprietor or self-employed shall be at least equal to the amount provided for in the second paragraph of Point 1 of Part A, Art. 7 of Act No. 90/2003 on Income Tax, cf. Art. 58 of that Act, cf. also Art. 3 of Act No. 129/1997.

Contributions to private pension divisions, B and C divisions

10.3. The amount of contributions paid to B Division, the private pension division, is voluntary. The proportion of the contribution base paid to a specified private pension in C Division depends upon the decision of the fund member, within the limits allowed by law and these Articles.

10.4. Contributions paid to B or C Division do not give entitlement to a pension from A Division or a predetermined pension. Disbursement of a balance in B Division is made pursuant to the provisions of Art. 19.3 and a balance in C Division is paid out in accordance with the provisions of Art. 20. 4.

End of contributions and limitation of liability for obligations

10.5. No one pays contributions to A Division of the fund after reaching age 70.

10.6. Fund members are not liable for the fund’s obligations beyond their contributions.

Remitting contributions and statements to fund members

10.7. Employers must deduct employees' contributions from their wages and remit them to the fund each month, together with their own portion of the contribution. At the same time, the employer must send the fund a remittance form for the contributions. The due date for each month's contribution is the

10th of the following month. If payment is not made within that month, default interest shall be charged on unpaid contributions from the due date to the date payment is made pursuant to provisions of the current Interest Act. Employers and self-employed persons must notify the pension fund if they are no longer obliged to remit contributions, as their employees have ceased work or they have ceased their own activities.

10.8. Paying fund members shall receive a statement at least twice a year of contributions paid on their behalf. The statements shall be accompanied by a request that fund members send notice without delay of any shortfall in remittance of contributions. If objections from fund members, substantiated by pay slips, have not been received by the fund within 60 days from the date of the statement and the fund is not aware of the contribution claim, the fund is only responsible for entitlement based on these contributions to the extent that they can be collected. However, the fund is not liable for entitlement arising from contributions lost through bankruptcy which are not covered by the Wage Guarantee Fund under Article 6 of Act No. 53/1993.Furthermore, the fund shall at least once a year send each paying fund member, in tandem with the statement of contributions, and those who have reached retirement pension age, information on their earned and projected entitlement, on the fund’s operations and financial situation, the main conclusions of the actuarial audit and any amendments to these Articles of Association.

The pension fund may send fund members the statements provided for in this Article by electronic means if members so request or if authorised by law or other currently applicable regulations. Statements shall then be made available to fund members on the members’ area of the fund's website.

Contributions in arrears

10.9. Contributions in arrears, which can be verified by means of submitted pay slips, shall be collected in the same manner as employers’ remittance forms. The fund may base collection actions on estimates of unpaid contributions, if the respective employer has not submitted remittance forms to the fund for

the period in question.

10.10. All employers' remittances, whether received with a new remittance form or otherwise, shall be credited towards the oldest unpaid contributions and default interest of the relevant employer. The fund’s Board may, however, derogate from this rule in cases where formal collection of contributions in

arrears for a specified period has commenced and an adequate guarantee has been provided for payment of contributions, default interest and collection costs for this period. Furthermore, if the law provides otherwise, cf. handling of matters during the employer’s moratorium. A remittance form amount is

considered unpaid until sufficient payment is made to fully cover the remittance form amount and interest accrued on it.

Division of entitlement between spouses

10.11. With an agreement between a fund member and spouse, the fund member can decide that up to half of contributions paid on their behalf, which are to establish a retirement pension entitlement under Art. 10.1 and 10.2, shall be used to create an independent retirement pension entitlement for their

spouse, cf. Art. 12.8.

11. The basis of pension entitlement

11.1. By paying contributions, fund members acquire the entitlement to retirement and disability pensions for themselves and the right to spouse’s and child’s pensions for their spouses and children, as provided for in Articles 11 to 15 and the fund’s entitlement tables I and II which are published in Annex A to

these Articles and comprise part of them. Minimum insurance coverage is based on contributions commencing at age 25. Table I shows annual retirement pension entitlements from the age of 67 years

for each ISK 10,000 contribution paid. Table II shows the reduction in retirement pensions if drawing of the pension begins before the age of 67 and the increase if drawing of the pension begins after age 67. The combined contributions of the fund member each calendar year form the basis of their

pension entitlement.

11.2. The entitlement to pension earned depends upon the age of the fund member at the end of the salary month for which a contribution is paid to the fund according to Table I of Annex A, cf. however, Art. 11.4. The entitlement is indexed and changes in accordance with changes in the Consumer Price Index

(CPI) used for indexation, from that of the salary month for which the contribution is paid. The pension entitlements are defined in Articles 12 to 15; cf. however, provisions of those articles concerning the continuing equal earning of pension entitlement.

Actuary's recommendations for new entitlement table

11.3. The fund's actuary shall make a proposal to the Board of Directors for new entitlement tables in Annex A, taking into account the fund’s future situation. The actuary shall furthermore propose new entitlement tables when the present discounted value of contributions to cover pension entitlements in the

age-related entitlement table is more that 5% less than or in excess of the present discounted value of age-related future entitlements. Such changes shall be presented to the fund's member organisations and at its annual general meeting.

Equal earning of pension entitlement

11.4. A fund member who held a pension entitlement at year-end 2005 may continue to pay contributions up to a certain maximum with equal earning of entitlement for as many months as the member had paid contributions prior to age 42 and before year-end 2005. If the member has, however, paid contributions for more than 5 years during this period they are entitled to pay up to the reference contribution for equal earning of entitlement up until age 70, cf. Art. 11.5.

11.5. The maximum contribution payable for equal earning of entitlement each year, referred to as the reference contribution, at most 10% of the contribution base, shall be determined for each fund member aged 25 to 69 years as equal to the contributions the member paid to the fund in 2003 or the last year in which contributions for that member were received by the fund if this was prior to 2003. A reference contribution is not calculated for members under 25 or older than 70 years of age on 1 January 2006. The above reference contribution shall be indexed to the CPI used for indexation from the reference

year to the payment year in each instance.

11.6. Equal earning of entitlement as referred to in Art. 11.4 is calculated in ISK as the average annual entitlement for each ISK 10,000 contribution from age 25 to 64 years according to Table I of Annex A to these Articles of Association, where the average is shown separately.

11.7. The fund’s Board shall inform members of the calculation of their reference contribution for equal earning of entitlement, as provided for above, within three months of their first payment to the fund after 1 January 2006. If, in the fund member’s estimation, the reference year does not give a fair picture of

their regular contribution payments, for instance, due to periods without work, or if payments were suspended during the year, the member may request to the Board that another year be used as the basis for calculating the reference contribution. The fund’s Board of Directors may then base the reference contribution on the nearest preceding year which gives a fair picture of the fund member’s regular contribution payments. A request for a review of the reference contribution must be received in writing by the fund no later than 9 months after the fund member was notified of the calculation of the reference contribution.

11.8. Contributions received in excess of the reference contribution referred to in Art. 11.5 create age-related entitlement according to Table I of Annex A.

11.9. All contributions received by the fund each year for a fund member who has a defined reference contribution as referred to above shall be credited towards equal earning of entitlement until the reference contribution has been reached or the calculated contribution payment period concludes, cf. Art. 11.4. A fund member who has a defined reference contribution may at any time decide that all of their contribution shall be credited towards entitlement under an age related entitlement table. The fund member’s decision on this shall take effect from the beginning of the year in which written notification from the member is received by the fund; this decision is irrevocable.

11.10. Contributions received by the fund on behalf of members who have been paying into the fund for less than 5 years before 42 years of age, cf. Art. 11.4, as of year-end 2005 shall be placed in equal earning of entitlement for as many months as the period of the member’s contribution payments prior to 42 years

of age, until the reference contribution is reached. In such instances the fund shall take care specifically that these members earn entitlement according to those rules which give them greater entitlement for the period in question.

11.11. As soon as contributions for a given calendar year are received for fund members who have a defined reference contribution, they shall be allocated to individual months in the same proportion as those contributions which have already been received. That portion of each month's contributions in excess of the reference contribution for the month shall give the member entitlement as provided for in Art. 11.2. If a fund member does not pay contributions for every month of a given calendar year, their reference contribution shall be calculated proportionally for the number of months paid.

11.12. Projection of entitlement pursuant to Articles 13 and 14 shall be based on equal earning of entitlement for the share of the member's reference contributions in those contributions used as a basis for projection of entitlement.

11.13. Projection of entitlement shall be made according to the rules which applied when the entitlement to a pension became active. The pension entitlement is the sum of earned pension entitlement and projected entitlement, if a ruling has been given on such entitlement.

11.14. When the Board of Directors decides on an increase in entitlement, this shall be kept separate from other rights. An increase in entitlement is not included in projection but is fully calculated in the earned entitlement. If the Board decides on a reduction in members’ earned entitlement, the reduction shall be applied in the same way as an increase in entitlement, except that the reduction is deducted from the earned entitlement.

11.15. The fund's Board may conclude agreements with other pension funds which have applied equal earning of entitlement in 2003 for mutual recognition of pension contributions in calculating the reference contribution referred to above. The fund may also participate with other funds in maintaining a

harmonised computer record of persons’ rights to equal earning of entitlement and provide for the allocation of this right if contributions are paid to more than one fund.

11.16. Fund members’ earned entitlements for contributions until the end of 2005 shall be preserved in accordance with those rules on entitlement which then applied. They shall be converted to ISK based on the points earned each year and the basic salaries in effect at year-end 2005. They then change on a

monthly basis in accordance with changes in the CPI used for indexation.

Projection

11.17. When projecting entitlement, subject to the relevant conditions which apply under Art. 13.5, calculation of a spouse's or disability pension shall be based on the average annual contribution payments of the three calendar years prior to loss of ability or death. If the average contribution payment is more than ISK 1,784,348, the projection of entitlement shall use the average contribution for up to 10 years and subsequently to age 65 using a contribution of ISK 1,784,348 per year plus half of the average contribution in excess of that. The amounts change at the beginning of each year to reflect changes in the CPI used for inflation indexation, with the base index 513.0 points in January 2022.

11.18. Should the salary paid to a fund member cease due to illness or unemployment, the member shall not earn any entitlement while this is the case. The period during which contributions have verifiably ceased for this reason shall not be included in determining whether the requirements for the contribution

payment period are satisfied.

Protection of earned entitlement

11.19. Entitlement to a retirement, disability and spouse’s pension is not cancelled even if a fund member ceases to pay contributions. The entitlement is then based only on the earned entitlement, cf. however, Articles 11.17 and 13.11.

12. Retirement pensions

12.1. A fund member is entitled to begin drawing a pension, as provided for in Art. 11, from the age of 60 to the age of 80 years.

12.2. The annual retirement pension of a fund member who begins drawing a retirement pension at age 67 is equal to the sum of their entitlement, calculated according to the provisions of Articles 11.1 and 11.16 and Table I in Annex A, cf. however, the provisions of Art. 12.8. on reciprocal and equal

division of retirement pension entitlement.

12.3. If the drawing of a pension begins before or after age 67, the retirement pension changes as provided for in Art. 11.1, i.e. is reduced if the drawing of the pension begins before the age of 67 and is increased if the drawing of the pension begins after the age of 67, according to Table II in Annex A.

12.4. A fund member’s decision to begin drawing their pension is final. Entitlement to a disability pension is therefore cancelled from the time retirement pension payments begin.

12.5. If a fund member continues to earn entitlement after beginning to draw a pension, their pension shall be recalculated annually at the beginning of each year of the fund member's age in accordance with Table I in Annex A.

Division of retirement pension between spouses

12.6. A fund member may conclude an agreement with their spouse to have up to half of the retirement pension payments to which the member is entitled paid to their spouse or former spouse. The pension fund shall then divide payments in accordance with the fund member's decision; they conclude, however, upon the death of the member. Should a spouse or former spouse who receives such payments, however, die before the fund member, all payments shall accrue to the latter.

12.7. A fund member can, on the basis of an agreement concluded with their spouse but no later than at age 65 years and if illness or ill health does not reduce life expectancy, decide that up to half of the value of the member’s accumulated pension entitlement shall be used to create an independent retirement

pension entitlement for their spouse or former spouse; in such case the fund member’s entitlement is reduced accordingly. The spouse's retirement pension shall be determined by an actuary's assessment ensuring that the fund's total liabilities do not increase as a result of this decision by the fund

member

12.8. An agreement between a fund member and their spouse, as referred to in the third paragraph of Art. 14 of Act No. 129/1997, cf. Articles 10.11, 12.6 and 12.7 of these Articles of Association, shall include, as appropriate, a reciprocal and equal division of the earned retirement pension entitlement of both parties as long as the marriage, registered partnership or registered cohabitation has

existed or exists.

Authorisation to draw half a retirement pension

12.9. A fund member who has not begun to draw a retirement pension from the fund may decide to begin drawing 50% of their retirement pension at any time after reaching the age of 60 years, and is then regarded as having allocated that portion of the pension, cf. Article 12.4. The provision of Art. 12.3 shall apply to that portion which is allocated before the age of 67 years. The provision of 12.3 shall apply to the deferred portion after the age of 67 years.

13. Disability pensions

13.1. A fund member who has not reached 67 years of age who suffers from loss of ability, cf. Art. 13.2, is entitled to a disability pension from the fund in accordance with earned rights under Art. 11 up until the loss of ability, provided they have paid contributions to the pension fund for a total of 24 months and has verifiably suffered a loss of income as a result of reduced work capacity.

Disability assessment and reassessment

13.2. A disability pension is paid if a member is assessed at least 50% disabled by the fund’s medical officer. The percentage of the loss of ability and the timing thereof shall be determined based on information on the previous health history and working ability of the fund member. The disability shall be evaluated every three years or according to the medical officer’s assessment.

13.3. An assessment of disability under Art. 13.2 shall, for the first three years, be based on the fund member’s inability to perform the job which granted them membership of the fund. After that period, the assessment of disability shall be based on the fund member’s inability to perform work in general.

Rehabilitation

13.4. The fund may, upon the opinion of its medical officer, make it a condition for payment of a disability pension that the fund member undergo rehabilitation which could improve their health.

Projection

13.5. In addition to their earned entitlement as provided for in Art. 11, a fund member is entitled to a projection of entitlement, cf. however, Art. 11.14, if they meet the following conditions:

a. has paid contributions to the fund for at least three of the previous four calendar years amounting to at least ISK 178,435 each of these three years. The amount changes at the beginning of each year to reflect changes in the CPI used for inflation indexation, with the base index 513.0 points in January 2022;

b. has paid contributions to the fund for at least 6 of the past 12 months;

c. has not suffered a loss of ability which can be attributed to abuse of alcohol, drugs or narcotics.

Projection of entitlement shall be based, in addition to earned entitlement, on the entitlement which the fund member would have earned up until 65 years of age based on their average contributions in the three calendar years preceding the loss of ability, cf. Art. 11.17.

13.6. If the fund member’s three-year average referred to in Art. 13.5 is disadvantageous due to illness or unemployment, the average entitlement of eight calendar years prior to the loss of ability can be used as the basis, in such case omitting both the calendar year which is least favourable and the calendar

year which is most favourable. If the fund member has paid contributions for less than eight years before the loss of ability, calculations shall be based on the relevant number of years.

13.7. If a fund member’s contributions to pension funds have been so irregular that they have lapsed or been less than ISK 178,435 per year for more than one calendar year after the end of the year in which the fund member reached 25 years of age, the projection time shall be reduced in proportion to the ratio of

calendar years in which the annual contributions have been less than ISK 178,435 to the total number of calendar years from age 25 until loss of ability. The amount changes at the beginning of each year to reflect changes in the CPI used for inflation indexation, with the base index 513.0 points in January 2022.

13.8. If a fund member has acquired the right to projection as provided for in Art. 13.5, which has lapsed due to a temporary absence from the labour market of up to 36 months due to studies, leave from work, having children or similar reasons, according to the fund's assessment, the right to projection shall be reestablished six months after they begin once more to pay contributions to the fund. The pension fund may request documentation to prove that the member had no income during the said period, and may request other documentation as necessary to assess the conditions of this provision and make such

provision of documentation a requirement for the application of the Article.

13.9. No disability pension is paid if the loss of ability referred to in Art. 13.2. has lasted less than six months. Disability pension is not paid for the first three months from the loss of ability.

13.10. The disability pension is equal to pension entitlement according to Articles 13.1. and 13.5. multiplied by the disability percentage under Art. 13.2. Reference income, relationship between disability pension and loss of income.

13.11. The sum of a disability pension and child’s pension shall never exceed the loss of income which the fund member has verifiably suffered due to disability. In assessing loss of income consideration shall be given to the disability pension recipient’s income from employment, pension and benefits from social

security and from other pension funds, as well as insurance benefits under wage contracts, which the member receives due to the disability. The pension fund may require certificates from the tax office, employer etc. as proof of this.

13.12. In order to assess whether the disability has resulted in a loss of income, a ruling shall be issued on reference income. This shall be the fund member’s average aggregate income in the last three years prior to the loss of ability, indexed to the date a ruling is issued, cf. the final paragraph of Articles 13.5,

13.6 and 13.8, on projection. The reference income shall then be indexed from the date of the ruling based on changes in the CPI.

Application for disability pension

13.13. A fund member who applies for or enjoys a disability pension is required to provide the fund with all necessary information on their health and income to determine the entitlement to a disability pension. In addition, disability pensioners are required to inform the fund of changes in their situation, e.g.

regarding their health or income, insofar as they could affect the right to a pension payment or its amount.

Disability pension vs. retirement pension

13.14. Disability pensions lapse at the age of 67, or earlier if working capacity increases or income increases, with the result that the conditions of Art. 13.11 are no longer satisfied. The retirement pension shall then be determined by adding to the earned entitlement an entitlement as determined in the ruling

on the fund member’s disability pension until age 65 as provided for in Art. 13.5, in the proportion of the member’s disability percentage at any given time.

14. Spouse’s pension

Right to a spouse’s pension

14.1. Upon the death of a fund member who has paid contributions to the fund, the member’s surviving spouse is entitled to a pension from the fund pursuant to the rules below, cf. however, Art. 11.19.

Minimum payment period

14.2. A full spouse’s pension pursuant to Art. 14.7 is always paid to a surviving spouse for at least 36 months and a half pension for an additional 24 months.

Entitlement for the youngest child

14.3. A surviving spouse is always paid a spouse’s pension, however, until the youngest child supported by the fund member reaches the age of 23 years, provided that it is supported by the spouse.

The surviving spouse is disabled

14.4. If the fund member’s spouse is at least 50% disabled and under 65 years of age, upon the death of the fund member they will receive a pension from the fund, until reaching 67 years of age, which is the same percentage of the spouse's pension provided for in Art. 14.7 as their loss of ability is assessed,

but not less than the equivalent of 60% of the fund member's earned disability pension upon death based on 100% disability. The disability shall be evaluated every three years or according to the medical officer’s assessment.

Spouse born before 1945

14.5. If a fund member's spouse was born before 1945, they are entitled to a spouse's pension. A spouse’s pension is calculated as provided for in Art. 14.7, but decreases by 2% for each year that the spouse was born after 1 January 1925, by an additional 2% for each year the spouse was born after 1 January

1930, by an additional 2% for each year the spouse was born after 1 January 1935 and by an additional 2% for each year the spouse was born after 1 January 1940.

15. Child's pension

Child's pension due to death of parent

15.1. Upon the death of a fund member, who has paid contributions for at least 24 of the past 36 months or for 6 of the past 12 months, received a retirement or disability pension, or acquired the right to projection under Art. 13.5, any natural or adopted children surviving them are entitled to a pension from the fund up to the age of 20 years as provided for in Art. 15.3.

Child's pensions due to disability

15.2. If a fund member, who has paid contributions to the fund for at least 24 months in the last 36 months, or satisfies the conditions of Art. 13.5.a and Art. 13.5.b, has received a ruling on a disability pension from the fund due to 100% disability, they are entitled to a child's pension for their natural and adopted children born or adopted prior to the loss of ability, together with natural children born during the following 12 months thereafter. If the disability pursuant to Article 13 is estimated to be less than 100%, the child’s pension from the fund shall be proportionally lower. A child's pension paid due to a fund member’s disability, does not expire even though the member reaches the age of retirement pension.

Amount of child’s pension

15.3. The full child’s pension is ISK 22,117 per child for each calendar month. The amount changes each month to reflect changes in the CPI used for inflation indexation, with the base index 513.0 points in January 2022.

Entitlement of foster children and stepchildren

15.4. Foster children and stepchildren, supported by the fund member mostly or wholly, shall be entitled to a child's pension, provided that the fund member has not begun drawing a retirement pension. The fund’s pension payments for such children shall be the same as they would be in the case of natural or

adopted children.

Child’s pension recipient

15.5. A child’s pension is paid to the child due to the death of a fund member and to the person supporting them due to the disability of a fund member.

16. Payment of pensions

16.1. An application for a pension shall be made in the format determined by the pension fund.

16.2. Pensions are paid at the end of each month for the preceding month.

16.3. A pension shall be paid for the month when the entitlement to it is established and for the month in which entitlement ceases.

16.4. A disability pension and spouse's pension shall not be paid retroactively for more than two years prior to the date an application is received by the fund. Payments under this provision shall reflect the price levels of the time. No interest is paid on pension payments. A retirement pension is paid after the application is received by the fund and not retroactively. If an application for a retirement pension has not been received when a fund member reaches age 70, the fund member shall be sent a letter informing them of their entitlement to a pension.

16.5. A pension is paid to the pensioner (cf. however, Art. 15.5) or the person to whom the pensioner has given a written power of attorney.

16.6. Pension payments, which are not collected within four years time, shall accrue to the fund.

16.7. If the amount of the pension payment is less than at least ISK 5,576 per month a lump sum payment may be made. This amount changes each month to reflect changes in the CPI used for inflation indexation, with the base index 513.0 points in January 2022.

17. Refund of contributions

17.1. Contributions may be refunded, if application is made, to foreign nationals who cease their fund membership due to emigration from Iceland, provided that such refund is not prohibited under international agreements to which Iceland is a party and that the person concerned was not an Icelandic national

when the entitlement was established. Any costs of insurance coverage enjoyed by the fund member, and the cost of management according to an actuary’s premises, may be deducted from the reimbursed contributions and interest. Contributions may not be reimbursed to nationals of other member

states of the European Economic Area (EEA) under existing international agreements.

17.2. If the contributions have been repaid, the pension entitlement based on them will lapse.

18. Agreements on reciprocal rights etc.

18.1. The Board of Directors may enter into agreements with other pension funds on arrangements for transfer of rights etc. Such arrangements may derogate from the waiting period and benefit provisions of these Articles, in order to prevent the lapse of entitlement when a fund member changes jobs and

duplication of rights which are not based on past contribution payment time. Furthermore, such arrangements may decide that the independent entitlements in individual funds should not exceed what the total rights would be in a single fund. However, such agreements shall not oblige the fund until they have received the approval of VR and those employers' associations which are members of the fund, cf. the second paragraph of Art. 2

18.2. The Board of Directors of the fund may, with the approval of the fund's member organisations, take over the assets and liabilities of other pension funds, provided that actuarial calculations are used as a basis for the acquisition.

19. B Division– private pension division

Agreements - refund

19.1. Persons requesting membership in the B-division, cf. Art. 4.8, shall conclude a written agreement with the fund to this end, as provided for in Act No. 129/1997, Reg. No. 391/1998 and Reg. No. 698/1998.

19.2. An agreement as referred to in Art. 19.1 may be terminated with two months’ notice. An agreement may be terminated if the rightholder under the agreement ceases the work which was the premise for their payment to the B Division. The termination of such an agreement does not confer a right to reimbursement of the balance or entitlement. If the rightholder so requests, they may conclude an agreement for the transfer of a balance or entitlement upon termination to a party authorised under Act No. 129/1997 to receive private pension savings and enter into a contract there.

19.3. Balances of rightholders in B Division shall be disbursed as provided for in the following rules, but never earlier than two years after the first payment of a contribution.

19.3.1. Pension payments from B Division can begin when the rightholder turns 60 years of age. Pension savings together with interest may be repaid either in the form of a lump sum or in equal payments.

19.3.2. Should the rightholder become disabled and the disability is assessed as 100% by the fund’s medical officer, the rightholder shall be entitled to have their balance in B Division repaid in equal annual payments over a seven-year period or during the period remaining until the beneficiary reaches 60 years

of age. If the disability percentage is less than 100% the annual repayment shall decrease in proportion to the reduction of the disability percentage and the repayment period shall be lengthened accordingly. If the rightholder wishes, a derogation may be made from the afore-mentioned repayment period if the balance is less than ISK 1,478,386. The amount changes at the beginning of each year to reflect changes in the CPI used for inflation indexation, with the base index 513.0 points in January 2022.

19.3.3. Upon the death of a rightholder, who holds a balance on a private pension account in C Division, the remaining balance is paid to their heirs and is divided between them according to rules of the Inheritance Act on legal heirs. Should a rightholder have no surviving children or spouse, any assets shall accrue to the rightholder's estate without limitation, cf. the second sentence of the second paragraph of Art. 8 of Act No. 129/1997.

19.4. The fund’s Board may offer more than one investment plan in B Division and formulate a separate investment strategy for each individual investment plan, as provided for in Art. 36 of Act No. 129/1997, which the rightholder can choose from in their agreement with the fund. If the fund offers more than one

investment option for the private pension division, a rightholder may request to transfer between the investment options under the rules set by the fund's Board.

20. C Division– specified private pension

Agreements - refund

20.1. Fund members may allocate contributions of up to 3.5% of the contribution base, in excess of 12% of the contribution base, to a specified private pension, which shall be preserved in C Division, if provision is made for this in a collective agreement or employment contract. Up until 1 July 2018, the 3.5% referred to in the first sentence of this Article shall be 2%.

20.2. Persons requesting membership of the C Division, cf. Art. 4.8, shall notify the fund thereof in a verifiable manner, following the rules laid down by the fund in accordance with the provisions of applicable laws and regulations. Similarly, fund members can send notification that they wish to discontinue part or all of their payments to the specified private pension and the contributions then

accrue to the mutual insurance division.

20.3. The pension fund shall alter the allocation of the contribution in accordance with the notified decision of the fund member as soon as possible and no later than within two calendar months from the date of verifiable receipt of notification. A decision to alter the allocation of the contribution does not

affect the contributions already allocated.

20.4. The rightholder’s balance in C Division is repaid according to the following rules.

20.4.1. Fund members may begin withdrawals from C Division from the age of 62 years, and payments shall then be distributed at least over the period remaining until the member reaches the age of 67. If the rightholder wishes, aderogation may be made from the afore-mentioned repayment period if the balance is less than ISK 1,478,386. The amount changes at the beginning of each year to reflect changes in the CPI used for inflation indexation, with the base index 513.0 points in January 2022.

20.4.2. Should the rightholder become disabled and the disability is assessed as 100% by the fund’s medical officer, the rightholder shall be entitled to have their balance in C Division repaid in equal annual payments over a seven-year period or during the period remaining until the beneficiary reaches 60 years

of age. If the disability percentage is less than 100% the annual repayment shall decrease in proportion to the reduction of the disability percentage and the repayment period shall be lengthened accordingly. If the rightholder wishes, a derogation may be made from the afore-mentioned repayment period if the balance is less than ISK 1,478,386. The amount changes at the beginning of each year to reflect changes in the CPI used for inflation indexation, with the base index 513.0 points in January 2022.

20.4.3. Upon the death of a rightholder, who holds a balance on a private pension account in C Division, the remaining balance is paid to their heirs and is divided between them according to rules of the Inheritance Act on legal heirs. Should a rightholder have no surviving children or spouse, any assets shall accrue to the rightholder's estate without limitation, cf. the second sentence of the second paragraph of Art. 8 of Act No. 129/1997.

20.5. The fund's Board may offer one or more investment plans in C Division. A separate investment strategy shall be formulated for each individual investment plan, as provided for in Art. 36 of Act No. 129/1997, as subsequently amended. If more than one investment plan is offered, the fund member shall state which plan they select with a notification to the fund in the form which it prescribes. If the fund offers more than one investment plan for C Division, a rightholder may request to transfer between the investment plan under the rules set by the fund's Board. A fund member who has not selected an investment option will be automatically transferred between the fund’s Ævileið options with increasing age, in accordance with the investment strategy.

21. Information disclosure obligation

21.1. In addition to the information disclosure provided for in Art. 10.8, the key results of the fund's operation shall be made public once each year in an advertisement in a daily newspaper or other effective manner, showing the key figures from its operations, financial situation and actuarial audit.

22. Assignment, mortgaging and attachment of pensions

22.1. The right to a pension cannot be disposed of or mortgaged.

22.2. Pension payments are exempt from attachment.

22.3. Balances in B and C Divisions can neither be assigned nor mortgaged, either in whole or in part, or disposed of in any other manner than authorised under 28 these Articles or the provisions of Act No. 129/1997, as subsequently amended.

23. Arbitration

23.1. Any dispute which may arise regarding these Articles of Association between member associations of the fund, shall be referred to an arbitration panel, comprised of three persons. Each of the disputing parties shall appoint one arbitrator and the third, who shall also be the chairman of the panel, shall be

appointed by the Supreme Court of Iceland.

23.2. If a fund member does not wish to accept a ruling by the fund’s Board in a matter which the member has referred to it, they may refer the matter to an arbitration panel. This must be done within three months of receiving written notification of the ruling. The arbitration panel shall be composed of three persons, one nominated by the fund member, one by the pension fund and a third, nominated by the Supreme Court of Iceland, who shall chair the panel. The arbitration panel shall rule on the case based on the claims, evidence, cause of action and other information available to the Board when it made its

decision in the case.If new evidence, cause of action or information is presented when the case is

being heard by the arbitration panel, the case shall be referred back to the fund’s Board of Directors for review. The fund’s Board is then obliged to re-examine and rule on the case. The ruling of the arbitration panel is final and binding on both parties. The cost of arbitration is divided between the parties according to the panel’s decision, but the fund member shall not pay more than 1/3 of the cost of the arbitration.

23.3. Arbitration proceedings are governed by the Act on Contractual Arbitration.

24. Amendments to the Articles of Association

24.1. Amendments to these Articles of Association shall be negotiated between VR and the employers' associations who are members of the fund, cf. Articles 2.2 and 5.1.

24.2. In order for an amendment to the Articles of Association to enter into force, it must have the approval of all the member organisations of the fund, cf. Art. 2.2, the approval of the Council of Representatives at the pension fund’s annual general meeting and confirmation by the Minister of Finance.

24.3. A motion to amend the Articles of Association shall be submitted and presented to each of the fund's member organisations a full two months before a decision on the proposal must be available. The motion for an amendment shall be considered by the fund's member organisations after it has been presented at the fund’s annual general meeting. If a motion is aimed at increasing entitlements or if it can be expected to affect the fund's ability to pay pensions, it must be accompanied by actuarial examination of the

consequences of the proposed amendment for the fund’s solvency.

24.4. The Board of Directors of the fund may amend the fund’s Articles without submitting the amendments to the fund’s member organisations and Council of Representatives, if the amendments result from mandatory provisions of Acts or Regulations. Amendments made pursuant to this provision shall be presented at the fund's next annual general meeting.

25. Entry into force

25.1. Amendments to the Articles of Association will take effect on, subject to the approval of the pension fund's member organisations and Council of Representatives at the AGM, cf. Art. 24 of the fund's Articles of Association, and confirmation by the Minister, cf. Art. 28 of Act No. 129/1997, as subsequently

amended.

25.2. Amendments to the Articles of Association that were approved by the Board at the AGM on 19 March 2024 will enter into force following confirmation by the Minister of Finance and Economic Affairs, with the exception of entitlement tables I and II in Annex A to the Articles of Association, which shall take effect on 1 January 2025.

25.3. Pensioners who had a better entitlement under older Articles shall retain their entitlement. This provision shall not affect the introduction of changes according to Annexes A and B to the Articles of Association.

Temporary Provision 1:

In the years 2023-2025, the outcome of projection of entitlement as provided for in Art. 13.5 shall be multiplied by the respective co-efficient from the following table for those persons awarded a disability pension each year:

• in 2023 1.06,

• in 2024 1.04,

• in 2025 1.02.

After 2025, the projection of entitlement will be as provided for in Art. 13.5 and this provision will be cancelled.

Adopted with those amendments approved at the annual general meeting of Lífeyrissjóður verzlunarmanna (LV) on 29 March 2022.

Stefán Sveinbjörnsson,Chair of the Board of Directors

Jón Ólafur Halldórsson, Vice-chair

Árni Stefánsson, director

Bjarni Þór Sigurðsson, director

Guðmunda Ólafsdóttir, director

Guðrún Ragna Garðarsdóttir, director

Ólafur R. Gunnarsson, alternate

Sigrún Helgadóttir, director

ANNEX A, Entitlement Tables, part of the Articles of Association

Annex A – Entitlement tables, part of the Articles of Association, shall be as follows:

ANNEX A, Entitlement Tables, part of the Articles of Association

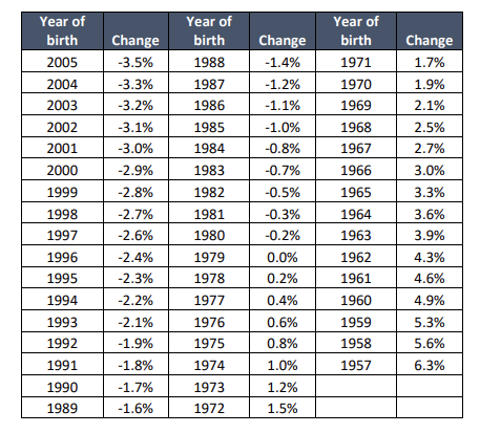

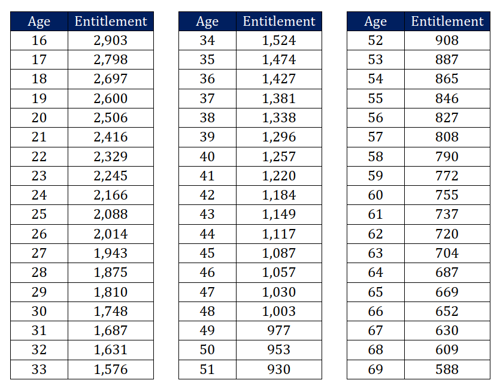

Entitlement Tables I and II, cf. Art. 11.1, applicable as of 1 January 2025. The tables replace the previously applicable entitlement tables I to IV, which took effect on 1 January 2023.

Table I: Annual pension entitlements from the age of 67 for each ISK 10,000 contribution paid by a fund member each year of age.

Equal earning of entitlement: average entitlement from age 24 up to and including age 64 years or ISK 1,202 for each ISK 10,000 contribution.

Assumptions:

- Interest 3.5% calculated annualy (p.a.)

- Mortality and survivor tables of the Association of Icelandic Actuaries (FÍT) of 2019, with a specific reduction from the standard mortality, based on the experience of LV fund members 2018-2022. The reduced mortality of fund members in the future is assumed, in accordance with FÍT predictions from 2021.

- Disability rates are based on the experience of fund members 2010-2014.

Gender ratio: Men 50%. Women 50%.

Table II: The reduction in the retirement pension if drawing of the pension begins before the age of 67 years and the increase if drawing of the pension begins after age 67 years.

The entitlement according to Table I is multiplied using the appropriate co-efficient based on the age at which drawing of the pension commences.

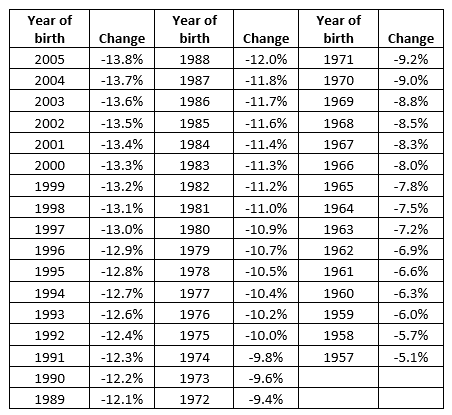

ANNEX B – Changes to earned entitlement in A Division, part of the Articles of Association

A summary of the specific changes to pension entitlements earned in the Lífeyrissjóður verzlunarmanna, approved by the fund’s Board of Directors after receiving the opinion of the fund's member organisations, as provided for in Art. 8.3 of its Articles of Association and the second paragraph of Art. 39 of Act No. 129/1997, on Mandatory Pension Insurance and on the Activities of Pension Funds.

1. On 20/01/2006, the fund's Board of Directors approved a 4% increase in pension entitlements of fund members earned in 2005 and earlier. The increase was recognised as an accrued obligation in the fund's entitlement scheme in December 2005 and entered into force upon the payment of pensions from the month of January 2006 onwards, cf. Art. 11.14 of the Articles of Association.

2. On 9/01/2007, the fund's Board of Directors approved a 7% increase in pension entitlements of fund members earned in 2006 and earlier. The increase was recognised as an accrued obligation in the fund's entitlement scheme in December 2006 and entered into force with the payment of pensions from the month of January 2007 onwards, cf. Art. 11.14 of the Articles of Association.

3. On 26/03/2010, the fund's Board of Directors approved a 10% decrease in pension entitlements of fund members earned in 2009 and earlier. The decrease was recognised as a decrease in the earned obligations in the fund's entitlement scheme in December 2009 and entered into force with the payment of pensions from the month of July 2010 onwards, Article 11.14 of fund’s Articles of Association.

4. On 30/09/2021, the fund's Board of Directors approved a 10% increase in pension entitlements of fund members in the mutual division earned in 2020 and earlier. The increase was recognised as an accrued obligation in the fund's entitlement system as of December 2020 and entered into force upon the payment of pensions from the month of November 2021 onwards. At the same time, the fund will pay an adjustment of 10% on pensions for the months of January to October 2021 inclusive. The change

is implemented as provided for in Art. 11.14 of the Articles of Association.

5. On 25/02/2022, the fund's Board of Directors approved a 12% increase in pension entitlements of fund members in the mutual division earned in 2021 and earlier. The increase was recognised as an accrued obligation in the fund's entitlement system as of December 2021 and entered into force as provided for in the provision on entry into force in Art. 25 of the Articles of Association. The change is implemented as provided for in Art. 11.14 of the Articles of Association.

6. On 25/02/2022 the fund's Board approved the introduction of new mortality and survivor tables, which were approved by the Minister of Finance and Economic Affairs in December 2021 and replace previous tables based on experience in 2014-2018. The change entered into force as provided for in Art. 25 of the Articles of Association. The change is implemented as provided for in Art. 11.14 of the Articles of Association.In connection with the above and in accordance with a proposal from the fund's

actuary, earned entitlement to a retirement pension shall be recalculated as provided for in subparagraphs a and b below. a) The fund's accrued obligations for all pension recipients, except recipients of child’s pension, shall be recalculated, together with obligations for others who have reached the age of 65, firstly, according to the new mortality and survivor tables and, secondly, according to previous mortality and survivor tables. The reference date for calculation shall be 31/12/2021. Fund members’ earned entitlement under the new mortality and survivor tables are recalculated so that the accrued obligations of A Division for this group will be the same proportion of the accrued obligations of A Division as they were under the previous mortality and survivor tables. It derives from the above that the earned entitlement of fund members who had reached the age of 65 before 1 January 2022 and the earned entitlement of

pension recipients other than recipients of child’s pension decrease by 4.3%. b) The accrued obligations for other fund members than those covered by subparagraph a of this Article, with the exception of recipients of a child’s pension, shall be calculated, firstly, according to the new mortality and survivor

tables and, secondly, according to previous mortality and survivor tables. The reference date for calculation shall be 31/12/2021. Fund members’ earned entitlement under the new mortality and survivor tables are recalculated so that the accrued obligations of each year of birth for this group will be the same

proportion of the accrued obligations of A Division as they were under the previous mortality and survivor tables. In other words, the accrued entitlement of each year of birth are recalculated so

that the accrued obligations of A Division for each year of birth will remain unchanged under the new mortality and survivor tables. It derives from this that earned entitlement decreases in accordance with the following table:

The cumulative impact of the changes in earned entitlement arising from Points 5 and 6 is shown in the following table.