A summary of the specific changes to pension entitlements earned in the Lífeyrissjóður verzlunarmanna, approved by the fund’s Board of Directors after receiving the opinion of the fund's member organisations, as provided for in Art. 8.3 of its Articles of Association and the second paragraph of Art. 39 of Act No. 129/1997, on Mandatory Pension Insurance and on the Activities of Pension Funds.

1. On 20/01/2006, the fund's Board of Directors approved a 4% increase in pension entitlements of fund members earned in 2005 and earlier. The increase was recognised as an accrued obligation in the fund's entitlement scheme in December 2005 and entered into force upon the payment of pensions from the month of January 2006 onwards, cf. Art. 11.14 of the Articles of Association.

2. On 9/01/2007, the fund's Board of Directors approved a 7% increase in pension entitlements of fund members earned in 2006 and earlier. The increase was recognised as an accrued obligation in the fund's entitlement scheme in December 2006 and entered into force with the payment of pensions from the month of January 2007 onwards, cf. Art. 11.14 of the Articles of Association.

3. On 26/03/2010, the fund's Board of Directors approved a 10% decrease in pension entitlements of fund members earned in 2009 and earlier. The decrease was recognised as a decrease in the earned obligations in the fund's entitlement scheme in December 2009 and entered into force with the payment of pensions from the month of July 2010 onwards, Article 11.14 of fund’s Articles of Association.

4. On 30/09/2021, the fund's Board of Directors approved a 10% increase in pension entitlements of fund members in the mutual division earned in 2020 and earlier. The increase was recognised as an accrued obligation in the fund's entitlement system as of December 2020 and entered into force upon the payment of pensions from the month of November 2021 onwards. At the same time, the fund will pay an adjustment of 10% on pensions for the months of January to October 2021 inclusive. The change

is implemented as provided for in Art. 11.14 of the Articles of Association.

5. On 25/02/2022, the fund's Board of Directors approved a 12% increase in pension entitlements of fund members in the mutual division earned in 2021 and earlier. The increase was recognised as an accrued obligation in the fund's entitlement system as of December 2021 and entered into force as provided for in the provision on entry into force in Art. 25 of the Articles of Association. The change is implemented as provided for in Art. 11.14 of the Articles of Association.

6. On 25/02/2022 the fund's Board approved the introduction of new mortality and survivor tables, which were approved by the Minister of Finance and Economic Affairs in December 2021 and replace previous tables based on experience in 2014-2018. The change entered into force as provided for in Art. 25 of the Articles of Association. The change is implemented as provided for in Art. 11.14 of the Articles of Association.In connection with the above and in accordance with a proposal from the fund's

actuary, earned entitlement to a retirement pension shall be recalculated as provided for in subparagraphs a and b below. a) The fund's accrued obligations for all pension recipients, except recipients of child’s pension, shall be recalculated, together with obligations for others who have reached the age of 65, firstly, according to the new mortality and survivor tables and, secondly, according to previous mortality and survivor tables. The reference date for calculation shall be 31/12/2021. Fund members’ earned entitlement under the new mortality and survivor tables are recalculated so that the accrued obligations of A Division for this group will be the same proportion of the accrued obligations of A Division as they were under the previous mortality and survivor tables. It derives from the above that the earned entitlement of fund members who had reached the age of 65 before 1 January 2022 and the earned entitlement of

pension recipients other than recipients of child’s pension decrease by 4.3%. b) The accrued obligations for other fund members than those covered by subparagraph a of this Article, with the exception of recipients of a child’s pension, shall be calculated, firstly, according to the new mortality and survivor

tables and, secondly, according to previous mortality and survivor tables. The reference date for calculation shall be 31/12/2021. Fund members’ earned entitlement under the new mortality and survivor tables are recalculated so that the accrued obligations of each year of birth for this group will be the same

proportion of the accrued obligations of A Division as they were under the previous mortality and survivor tables. In other words, the accrued entitlement of each year of birth are recalculated so

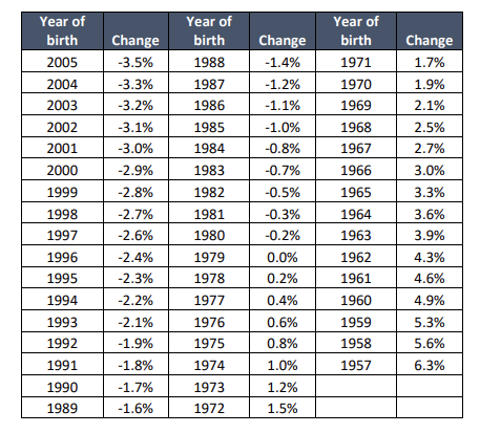

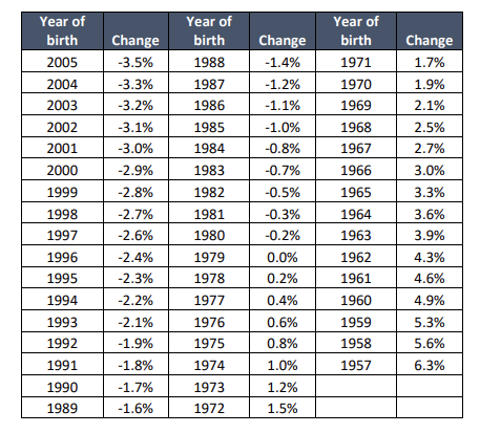

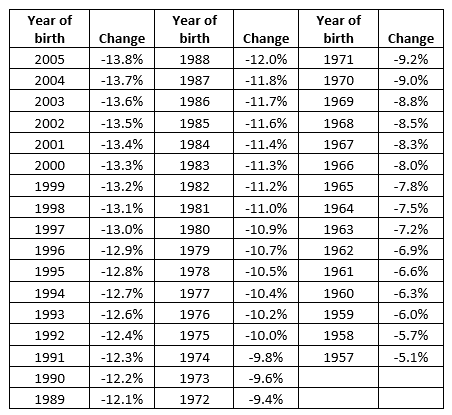

that the accrued obligations of A Division for each year of birth will remain unchanged under the new mortality and survivor tables. It derives from this that earned entitlement decreases in accordance with the following table:

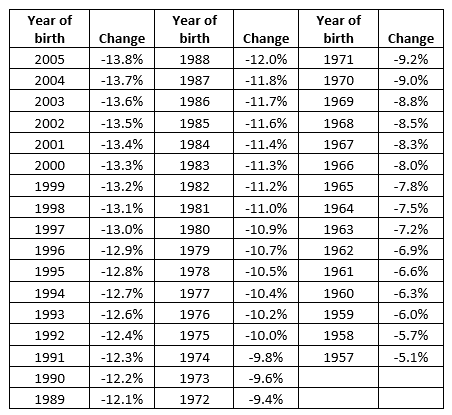

The cumulative impact of the changes in earned entitlement arising from Points 5 and 6 is shown in the following table.